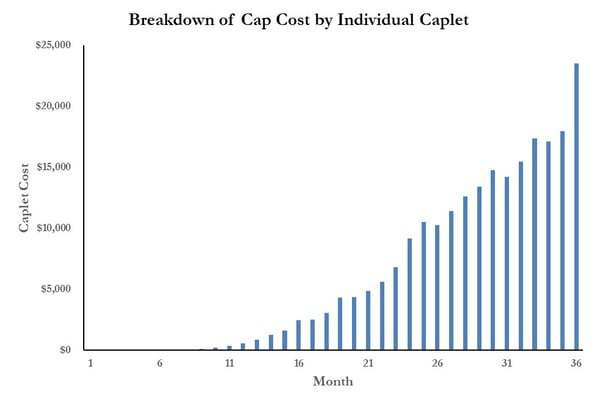

option pricing - Find the caplet volatilities for LIBOR fixings at each interval, given the ATM implied cap volatility term structure - Quantitative Finance Stack Exchange

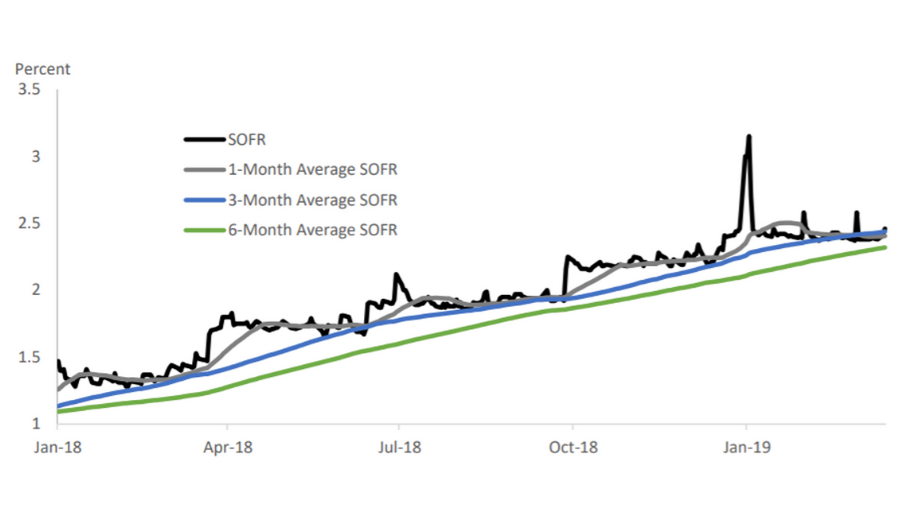

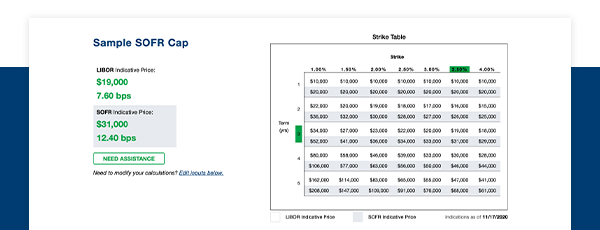

Thirty Capital Financial's SOFR With Ease™ Creates the First and Only Online SOFR Based Interest Rate Cap Calculator

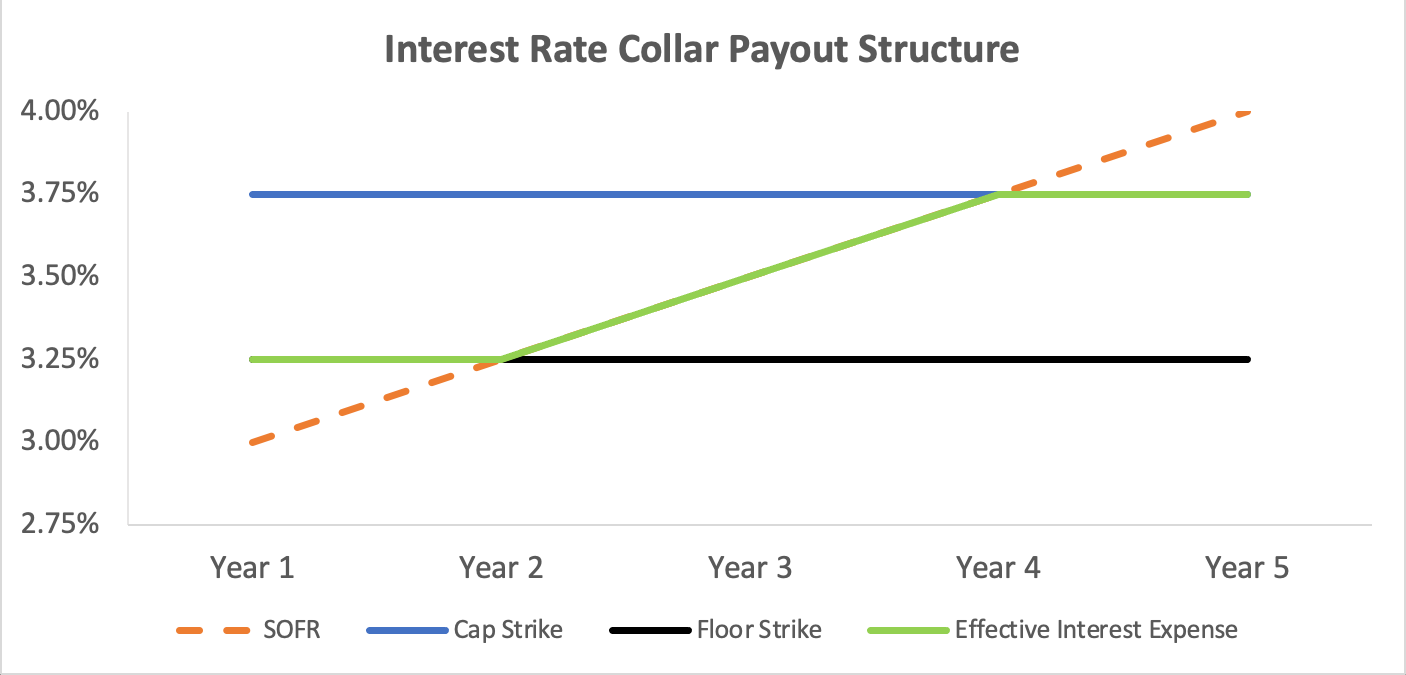

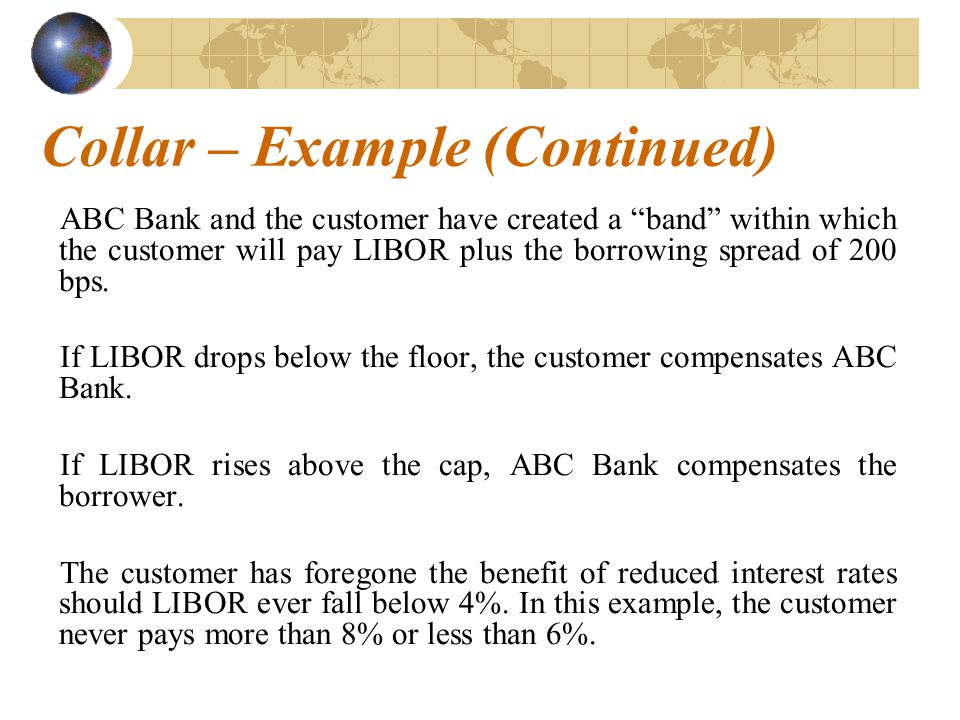

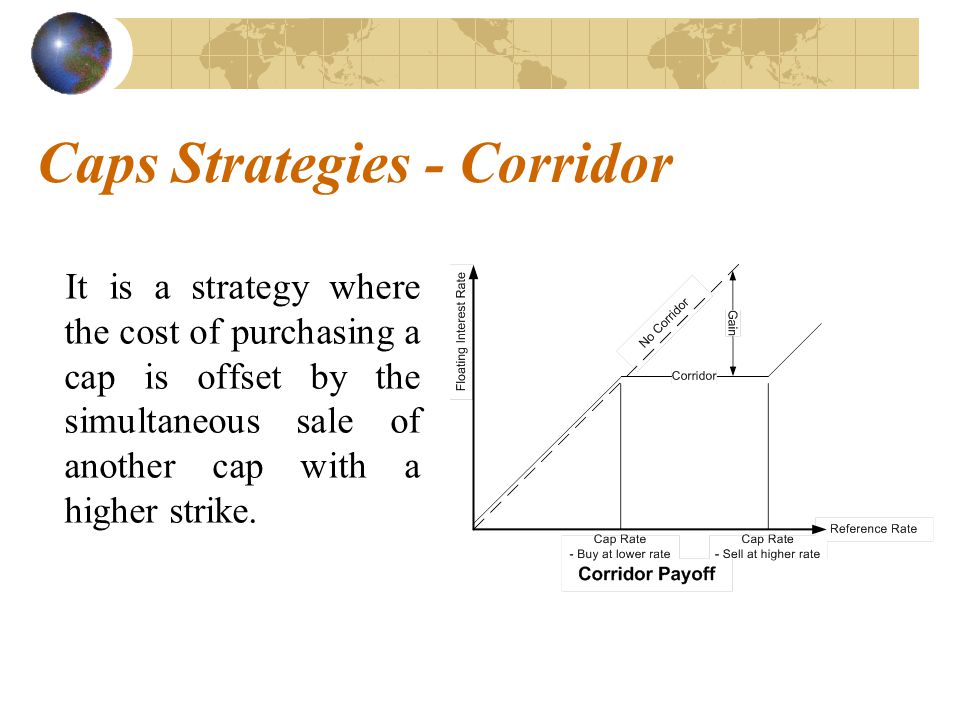

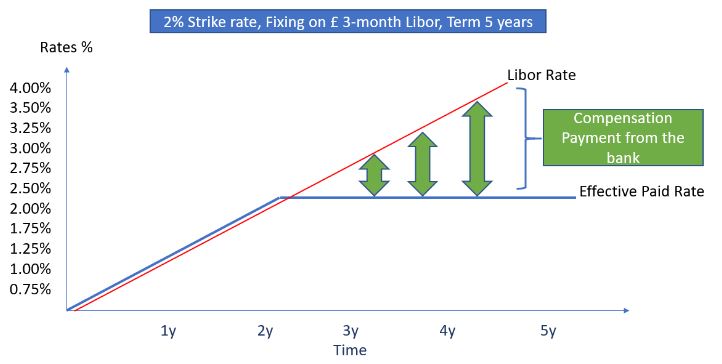

Suppose that you buy an interest rate cap on 3-month LIBOR with a 2-year maturity and simultaneously sell a floor on 3-month LIBOR with a 2-year maturity. Ignore the premiums. Draw a

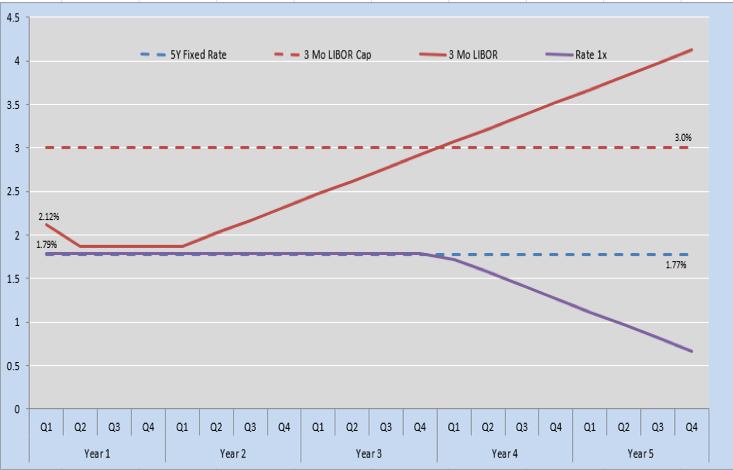

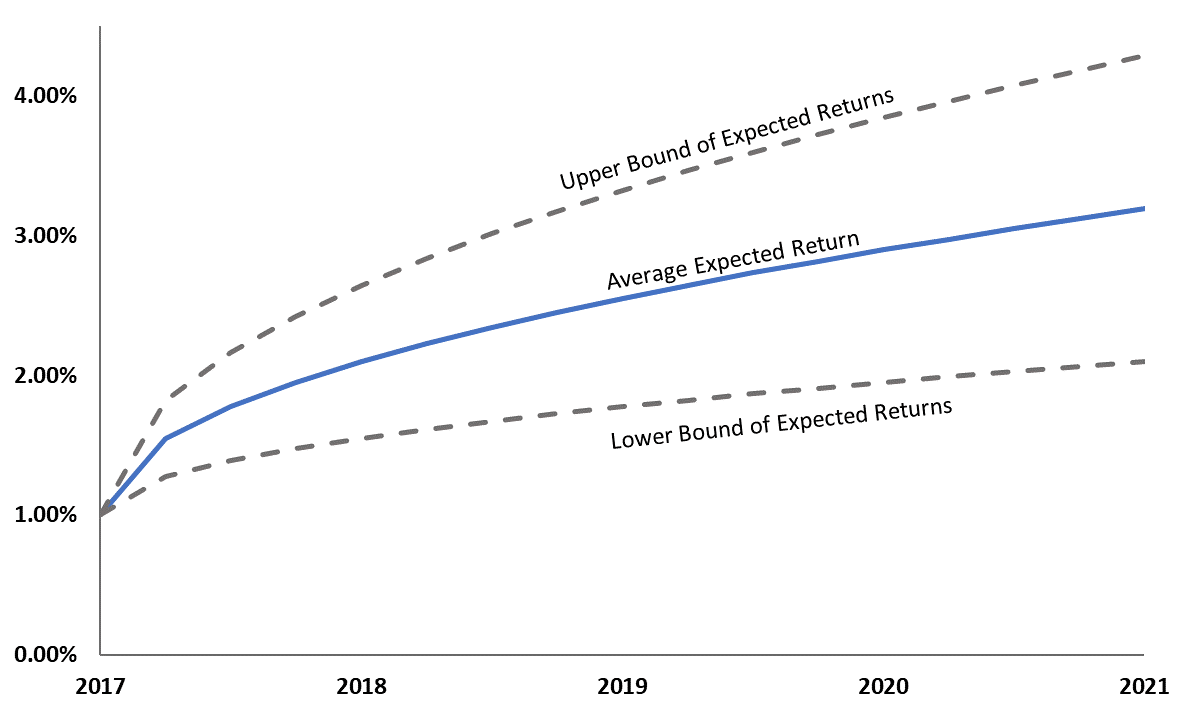

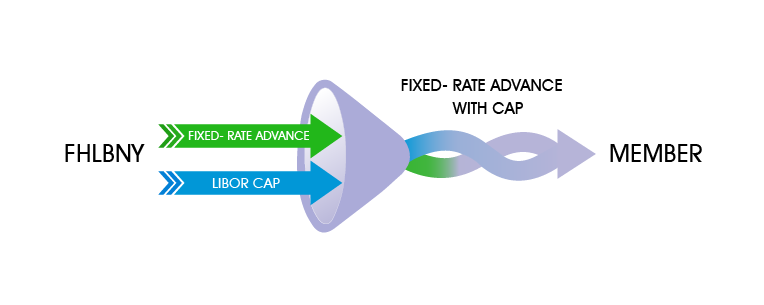

What Goes Up Must Come Down—Managing Interest-Rate Risk with the Fixed-Rate with Cap - Federal Home Loan Bank of New York